Small and medium enterprises (SME) Loan

WeLend SME Loan: Empowering Small Businesses

No 1 The Challenge

Unlocking Growth for SMEs

“How can we help small businesses access funding quickly and easily?”

Small and medium-sized enterprises (SMEs) are the backbone of the economy, but many face challenges in securing loans due to lengthy processes, complex paperwork, and lack of transparency. WeLend set out to solve these issues with a digital-first lending platform tailored to the unique needs of SMEs.

Key Problems

- Time-Consuming Applications: SMEs struggled with manual, paper-heavy processes.

- Lack of Clarity: Business owners often didn’t understand eligibility criteria or loan terms.

- Urgency for Funds: Traditional approvals were too slow to meet the fast-paced needs of SMEs.

No 2 The Vision

A Faster, Smarter Way to Fund SMEs

The goal was to create a platform that:

- Streamlines the loan process with simple, digital workflows.

- Provides instant eligibility checks and faster approvals.

- Supports business growth by delivering funds quickly and reliably.

WeLend envisioned a platform where businesses could apply for loans in minutes, not weeks.

No 3 The Journey

Designing for Business Owners

Research and Insights

- Conducted 10+ business owner interviews to understand their pain points.

- Key Findings:

- Owners needed speed and simplicity in the loan process.

- Many felt overwhelmed by financial jargon and required clear loan terms upfront.

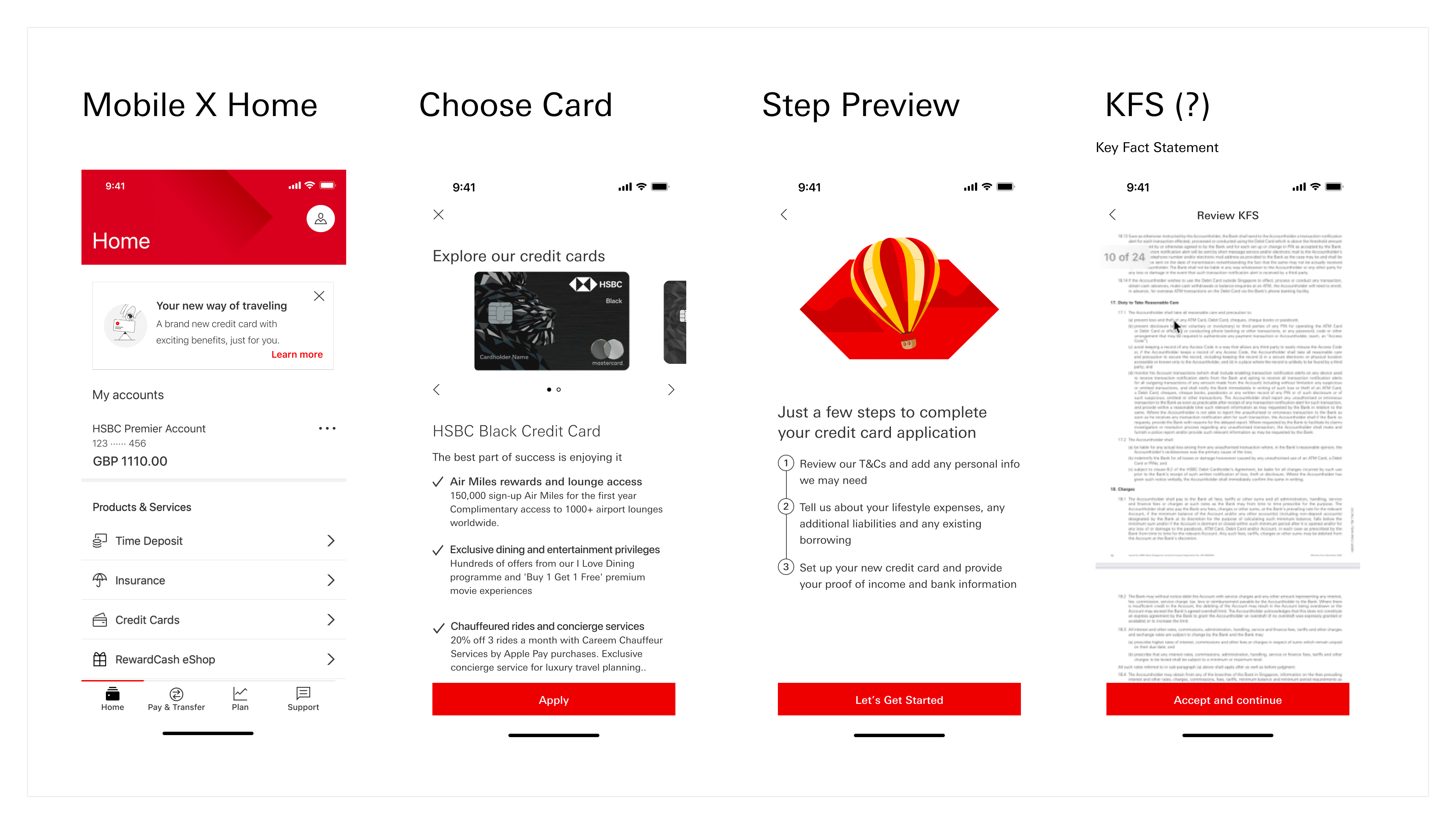

Prototyping and Testing

- Designed user flows that broke the loan application into bite-sized steps.

- Created interactive prototypes and tested with real users, focusing on:

- Clarity: Simplified instructions and progress indicators.

- Speed: Reduced required inputs by automating document verification.

- Iterated based on user feedback, cutting application time by 40%.

Implementation

- Collaborated with developers to build a mobile-friendly platform with robust security and seamless integrations for document uploads and approvals.

No 4 The Solution

A Simple, Fast Loan Experience

The final platform transformed the SME loan process by:

- Automating Eligibility Checks: Business owners could see if they qualified within seconds.

- Streamlining Documentation: Users could upload financial records directly from their devices.

- Speeding Up Approvals: Loans were approved in as little as 24 hours, enabling businesses to act quickly.

No 5 My Role

Driving User-Centered Design

As the UX Designer, I:

- Conducted user research to uncover SME pain points.

- Designed workflows and prototypes that simplified the loan journey.

- Led usability testing, ensuring the platform met business and user needs.

- Worked with developers to implement responsive designs and intuitive user interfaces.

No 6 The Impact

Empowering Small Buinesses

The WeLend SME Loan platform delivered measurable results

- 35% faster loan processing times, enabling businesses to act on opportunities quickly.

- 20% increase in loan applications due to a more accessible and intuitive design.

- Business owners reported higher satisfaction, citing the platform’s ease of use and transparency.